“Rotterdam is the natural start and final stage of the Silk Road”

- Interviews

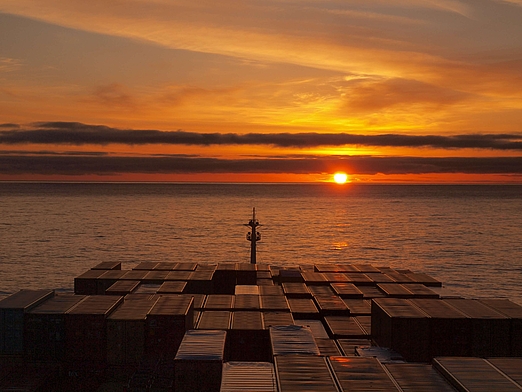

The port of Rotterdam is one of the largest seaports in the world and by far the largest deep water port in Europe. The port at the mouth of the Rhine into the North Sea handled a total volume of 467.4 million tons of sea freight in 2017.

The port is located on one of the busiest waterways of the world and, unlike most other North Sea ports, can be accessed by ships with a draft of up to 24 meters. We took the opportunity to talk to Emile Hoogsteden, VP Containers, Breakbulk and Logistics at the Port of Rotterdam, about German competitors, the dangers of the impending Brexit and China's New Silk Road.

"With regard to cooperation between ports, our motto is: Where possible, we are working together with other ports, for example in the area of sustainability or security.

But we are competitors in areas where we need to be competitors."

Emile Hoogsteden summarizes Rotterdam's position as the leading port in Europe.

“With regard to Brexit, the Port of Rotterdam is hoping for the best but is preparing for the worst, the worst meaning a no deal hard Brexit. We urgently call on both the private sector and government – at the national and European level – to make serious preparation for Brexit. The clock is ticking.”

Hoogsteden calls for an level-headed view of Brexit, independent of the final outcome.

Our rail service is 50% faster than sea cargo and 60% less expensive than air cargo, giving you the best of both worlds.

Rail transport is a fast, cost-effective and environment-friendly alternative to air and sea freight. Our specialized teams will create the optimal rail transport concept for any commodity.

Find out more