China’s growing automotive sector and its opportunities for airfreight

All electric in the Middle Kingdom?

- Facts

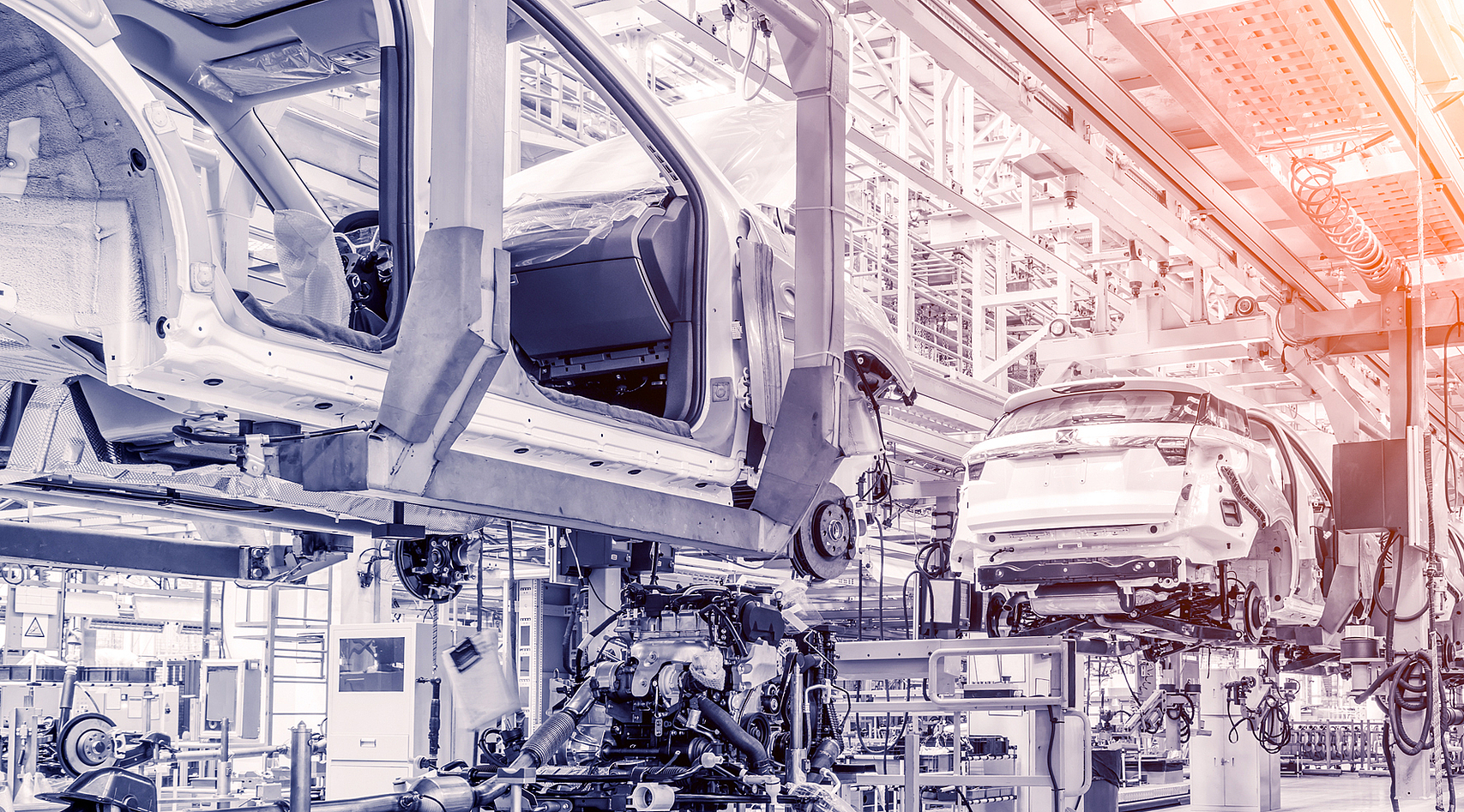

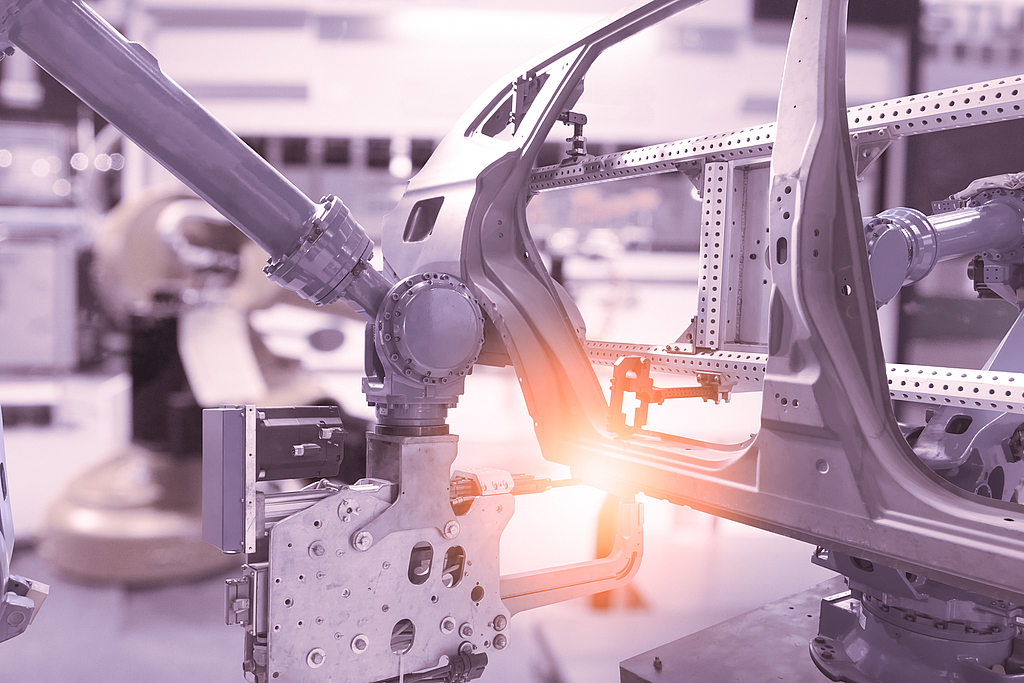

The Chinese automotive industry is currently undergoing a period of industrial modernization and transformation as Chinese brands play an increasingly important role on the global automotive market. Especially in the field of electric vehicles, China is picking up speed. We took a closer look at this fascinating development and the opportunities it brings for the air cargo industry. Whether it’s fire-resistant transport containers for batteries or emergency transports of a few essential screws – the challenges are electrifying.