The online giants facing COVID-19, Christmas shopping and each other

How Amazon and Alibaba are splitting the global online shopping business between them

- Facts

It didn’t take a pandemic for e-commerce revenues to set new world records year after year. While consumers spent 1.3 billion US dollars at thousands of portals in 2014, revenues in 2019 were already up to 3.5 billion. This year, the unforeseen “boost” from COVID-19 is expected to drive global online shopping to more than 4.2 billion US dollars. Sounds pretty impressive, huh?

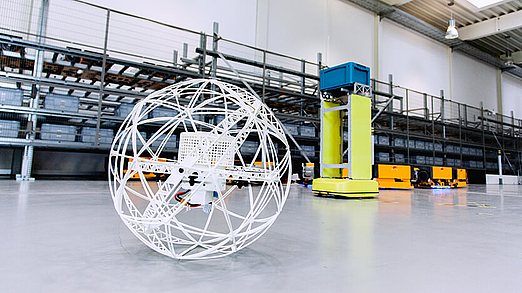

We offer specialized logistics solutions and warehousing facilities for the requirements of a range of industries.

Uniform standards in all of our logistics centers around the world ensure high quality and reliability. Benefit from our comprehensive network of warehouses in Europe, Asia and the USA.

Find out more