“...weaker demand and lower shipping prices are having a major impact”

- Interviews

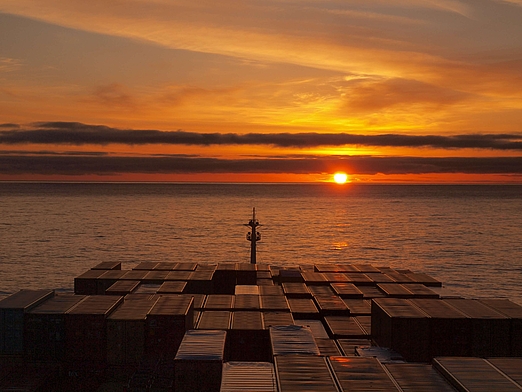

With a fleet of 258 modern container ships and a total transport capacity of 1.9 million TEU, Hapag-Lloyd is one of the world’s leading liner shipping companies. Headquartered in Hamburg, the company is known as the fifth largest container carrier worldwide. We had the opportunity to invite Rolf Habben Jansen for a talk about the recent developments in seafreight, acquisition plans and ice hockey.

“I don’t think we will see ships with much more capacity in the foreseeable future that would merit a new ship type designation. ”

Rolf Habben Jansen thinks the ship size limit has been reached for now

“China is a key factor in global production and invests continuously. At the same time, however, the topic of 'near-shoring' has been gaining in importance.”

...on China's production capacities and "near-shoring" trends.

“While 'big players' have extensive resources and global reach, working with a mid-sized freight forwarder offers a more personal and flexible approach. That can be an advantage, especially in our volatile and dynamic industry, where it is important to be able to react quickly and efficiently”

Habben Jansen on the successful cooperation between both companies