“We should continue to build on our trump cards”

- Interviews

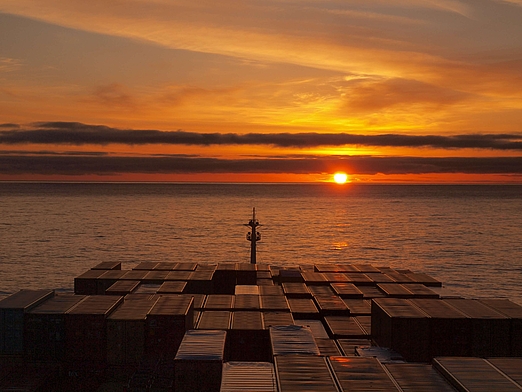

The port of Antwerp in Flanders, Belgium, is an important hub in the heart of Europe accessible to capesize ships. It ranks second behind Rotterdam by total freight shipped and handled 235.2 million t of sea cargo in 2018. We talked to Luc Arnouts, Director International Relations & Networks, about the latest developments in the industry.

“We have always been a logistics platform and not just a transshipment port.”

Luc Arnouts highlights the strenghts of the Port of Antwerp.

“The UK is our second most important overseas trading partner. We immediately reacted and started a Brexit Task Force in 2016.”

On the port's preparations for the Brexit.

“We should continue to build on our trump cards, which are not only low costs but also our service reliability and our multi-modal offering.”

Luc Arnouts on the competition with China’s “New Silk Road” or Europe’s southern ports.

Our rail service is 50% faster than sea cargo and 60% less expensive than air cargo, giving you the best of both worlds.

Rail transport is a fast, cost-effective and environment-friendly alternative to air and sea freight. Our specialized teams will create the optimal rail transport concept for any commodity.

Find out more