"The massive restrictions are behind us, but disrupted supply chains remain"

- Interviews

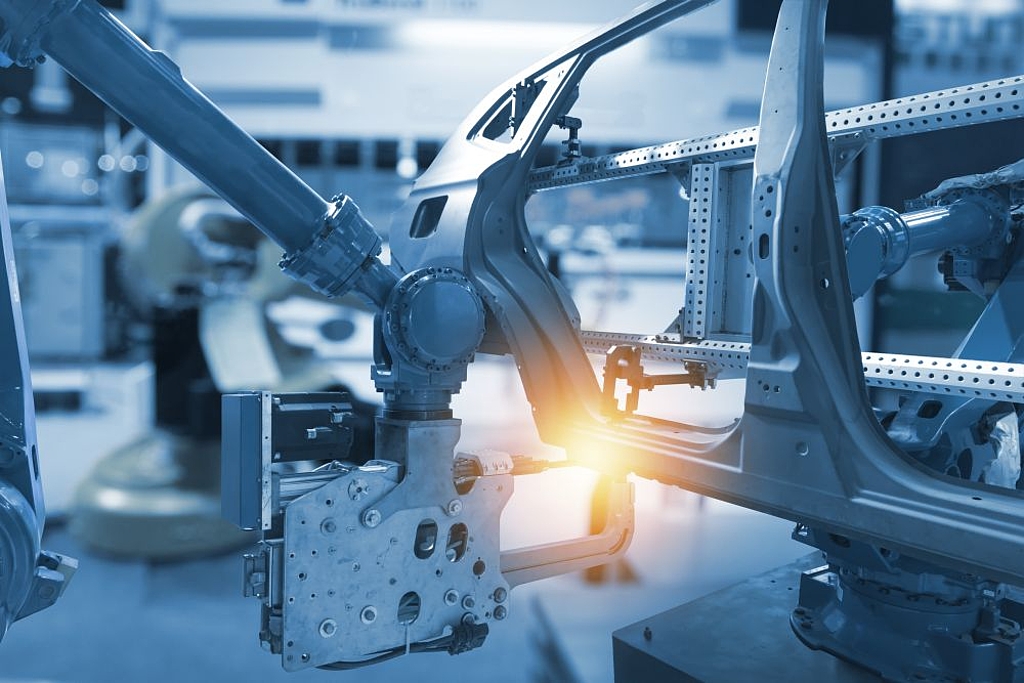

The automotive sector is a major global industry that will undergo extensive transformation in the years to come. Numerous innovations, such as autonomous driving or a paradigm shift regarding the propulsion method, are waiting on the horizon and "moving" the industry. Of course, the COVID-19 pandemic also had a major impact on the automotive sector. We took this as an opportunity to talk to Florian Danmayr, an absolute expert in this area. Find out more about reduced magnesium mining rates in China, the importance of medium-sized companies for the industry and a possible connection between near-shoring trends and CO₂ pricing.

"In places where cost is the only major factor, I see our climate goals as a motivation to move in the direction of near-shoring. Once there is a CO₂ price (including transport) and this must be included in the calculation, the cards will be reshuffled. That will be a big opportunity for production in Europe."

Florian Danmayr on near-shoring trends in the automotive industry.

We offer specialized logistics solutions and warehousing facilities for the requirements of a range of industries.

Uniform standards in all of our logistics centers around the world ensure high quality and reliability. Benefit from our comprehensive network of warehouses in Europe, Asia and the USA.

Find out more