Trade Analysis: Transpacific

Shipping lines are reducing capacity on this trade due to low demand, which has contributed to further rate declines. Carriers were not able to build a large roll pool prior to the holidays…

read moreRead our Seafreight Insights to find out about the latest developments in the global sea cargo industry. Get an update on trade and rate developments as well as flexible solutions offered by cargo-partner to deal with the current challenges.

The seafreight market in 2025 was characterized by high volatility and geopolitical instability, driven in particular by the Red Sea crisis and US trade tariffs. These factors caused major disruptions in terms of trade patterns and freight rates. With political tensions expected to persist, the market is likely to remain challenging.

Key market dynamics and trends include:

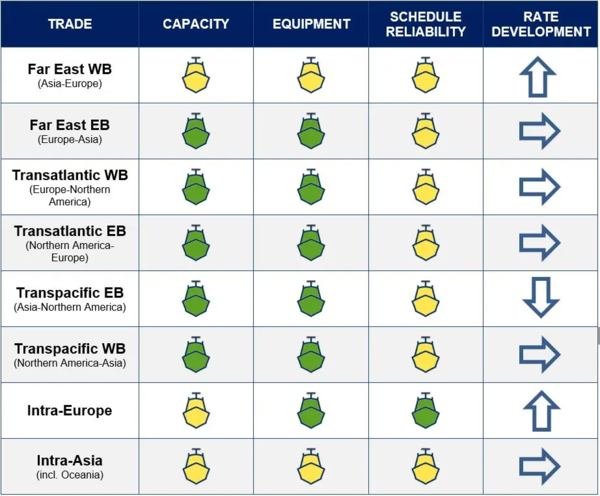

Legend: traffic lights showing current status, arrow indicates possible development of transport rates.

Shipping lines are reducing capacity on this trade due to low demand, which has contributed to further rate declines. Carriers were not able to build a large roll pool prior to the holidays…

read moreWhile European shipping lines have rotated most, if not all, of their China-built container ships out of US services, some Chinese carriers stated in an initial announcement that they…

read more

Pricing on this trade remains low and stable for now, though schedules are still being affected by the situation in the Red Sea as well as ongoing congestion at European ports.

read more

Space is widely available, and short-term rates continue to decline. Carriers have introduced some blank sailings to curb overcapacity, but no large-scale reductions have been announced so…

read more

Global supply chains have recently been challenged by disruptive US tariff policies and geopolitical instability. In this landscape, Mexico is gaining importance as a key hub for North…

read more

A new sea freight consolidation service offers streamlined, end-to-end transport solutions from Japan to Central and various locations in Eastern Europe.

read more

Nuclear propulsion has long been imagined as a revolutionary way to power everything from ships to cars and trains. Let's explore a new take...

read more

Today’s "maritime monsters" can transport over 24,000 containers and now there are plans for a new record-breaking ship.

read more

Reefer ocean freight is currently still volatile, but with rates on a comparatively low level. Read more about our experts' current reefer market assessment...

read more

The Antwerp-Bruges container port is moving ever closer to its competitor Rotterdam in a recent ranking of the largest European ports. The Belgian port’s container throughput grew by 4.1%…

read more